UK: This is a Financial Promotion. For Information Purposes Only, this presentation should not be used as a basis for investment decision.

Inflation remains the main problem

We continue to forecast the major economies to grow this year, not fall into recession, although we expect growth to slow significantly in H2.

Inflation should continue to moderate, but sustained growth is likely to keep the pace of disinflation too gradual for Western central banks’ comfort.

The “Godot recession” rolls on. Interest rate markets are priced for recession and rate cuts. Yet, we still forecast the major economies to grow this year and next, not fall into recession.

The recent banking sector stress in the USA and Europe increases the risk of a recession-inducing credit crunch. Credit conditions are going to tighten more and sooner than if these shocks had not happened, particularly in the USA. However, the starting conditions for the economies going into this stress, combined with the effectiveness of the policy responses, imply that a credit crunch recession remains a risk, not a necessity.

Most important, even if economies do dip into recession, central banks may not cut rates as rapidly or as deeply as markets currently have priced.

Price increases still strong enough for more hikes

US inflation remains too high for the US Federal Reserve’s comfort. Consumer price index (CPI)data for March showed downward pressure on headline inflation, led by energy and food prices. But the run rate of core inflation, especially when stripped of its most volatile components, remained comfortably above target with only gradual signs of a downtrend.

Meanwhile, US GDP is set to register another quarter of strong growth to begin the year, coming on the heels of 2.6% growth in Q4 last year. All of this combines with a still strong pace of jobs growth and historically high rates of wage growth.

Against this background, the recent bank failures and resulting stress in the USA and Europe may prove to be favorable for the Fed and the European Central Bank (ECB). The major central banks need weak, sub-potential growth, not sustained above-trend growth in the USA and an acceleration in the Eurozone.

We expect this acceleration of the deposit channel of monetary policy transmission to allow the Fed to end its hiking cycle with one more 25 bp rate hike in May, reaching a terminal rate of 5.00%-5.25%, and the ECB to stop after 75 bp of additional tightening to 3.75%. We see the Bank of England stopping interest rate hikes at 4.5%. We do not expect any of the major central banks to cut rates this year. In our view, Fed cuts are only likely in Q1 2024.

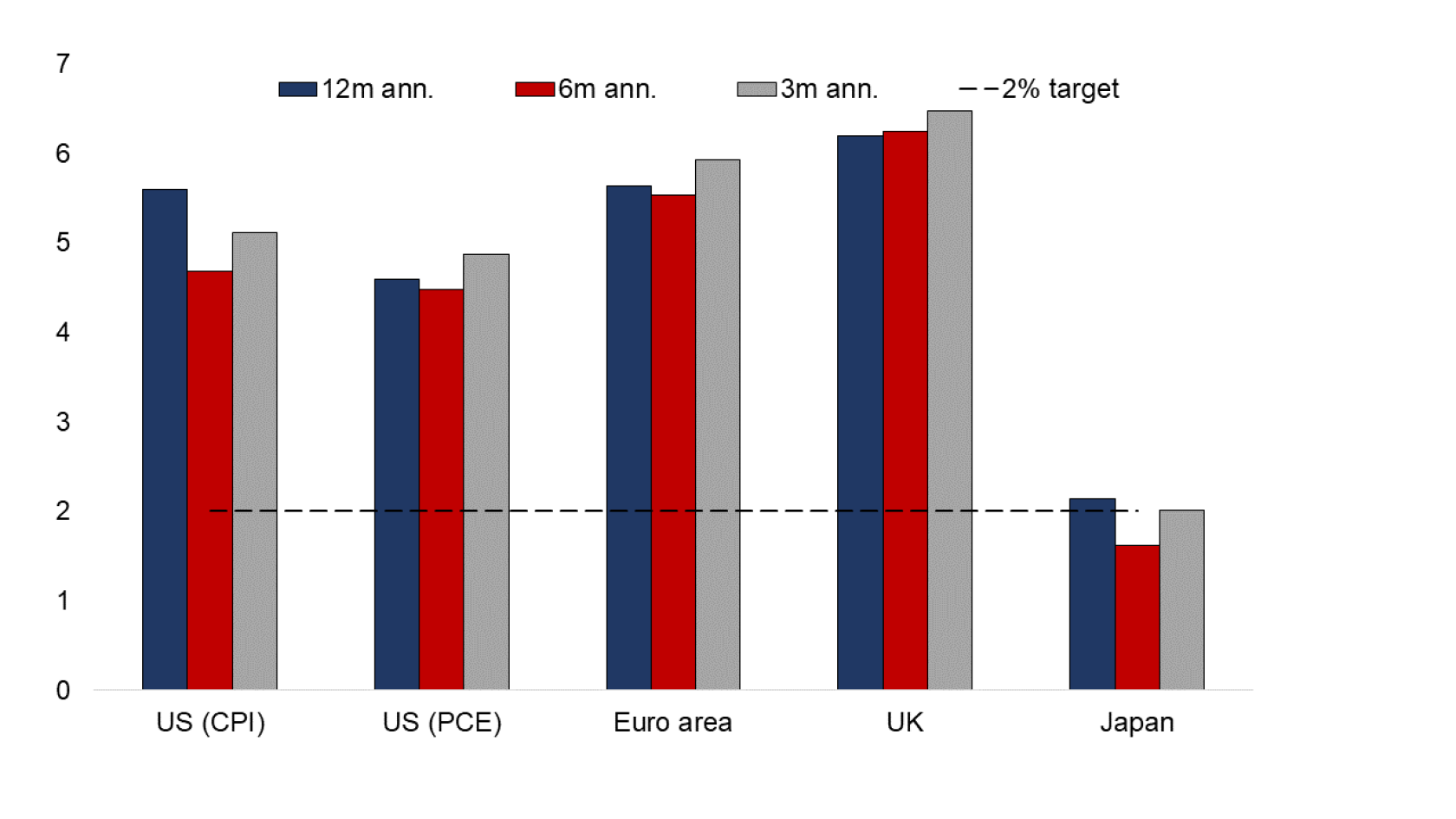

Core inflation momentum still too high in major economies

MoM % avg annualized over time horizon stated

Historical performance indications and financial market scenarios are not reliable indicators of future performance.

All investments involve some level of risk. Simply defined, risk is the possibility that you will lose money or not make money. Before you invest, please make sure you understand the risks that apply to the products. As with any investment, you could lose money over any period of time.

Interest rate and credit risks: The retention of value of a bond is dependent on the creditworthiness of the Issuer and/or Guarantor (as applicable), which may change over the term of the bond. In the event of default by the Issuer and/or Guarantor of the bond, the bond or any income derived from it is not guaranteed and you may get back none of, or less than, what was originally invested.

To the extent that these materials contain statements about the future, such statements are forward looking and are subject to a number of risks and uncertainties and are not a guarantee of future results.

Monthly “90 seconds with” podcast: September 2023

Still focused on quality