UK: This is a Financial Promotion. For Information Purposes Only, this presentation should not be used as a basis for investment decision.

Rising AI adoption in investors’ focus

Artificial intelligence (AI) is a sub-theme of our Supertrend “Technology at the service of humans”. The structural digitalization of our economies and societies further pushes demand for AI-based technology. In addition, rising inflation and interest rates put pressure on companies’ margins and trigger investments into more efficient automated business processes. Using AI in different solutions is helping various industries to reduce their cost base. It is also creating innovations that are generating new markets, be it in healthcare, education or in the industrial sector to name a few. However, from an investment point of view, the IT sector should benefit the most. New generative AI applications like ChatGPT have opened up new monetization opportunities for the sector.

AI market at an inflection point

Within the IT industry, some markets are rapidly expanding and looking to bring in new perspectives. For example, the hot topic in how digital innovation can lead to higher productivity is the rising adoption of artificial intelligence applications. The AI-based ChatGPT bot (a natural language processing tool from the privately owned company OpenAI, which uses AI technology that allows you to have human-like conversations and much more) conquered the world at the end of 2022 and gained more than 100 million users in just two months, much faster than other established apps such as Instagram or TikTok, which required 8 months and 1.5 years, respectively, to reach that user base. It potentially disrupts the content creating and software programming market and might be able to revolutionize the way we think about efficiency gains in knowledge work. Microsoft recently announced that it will invest USD 10 bn in OpenAI, which will help the latter to develop the tool further, and will offer the application to its cloud service customers soon. Google’s CEO mentioned in its Q4 results analyst call that “AI reaches an inflection point” and that the company will make new language models like ChatGPT available to its customers as well in coming weeks.

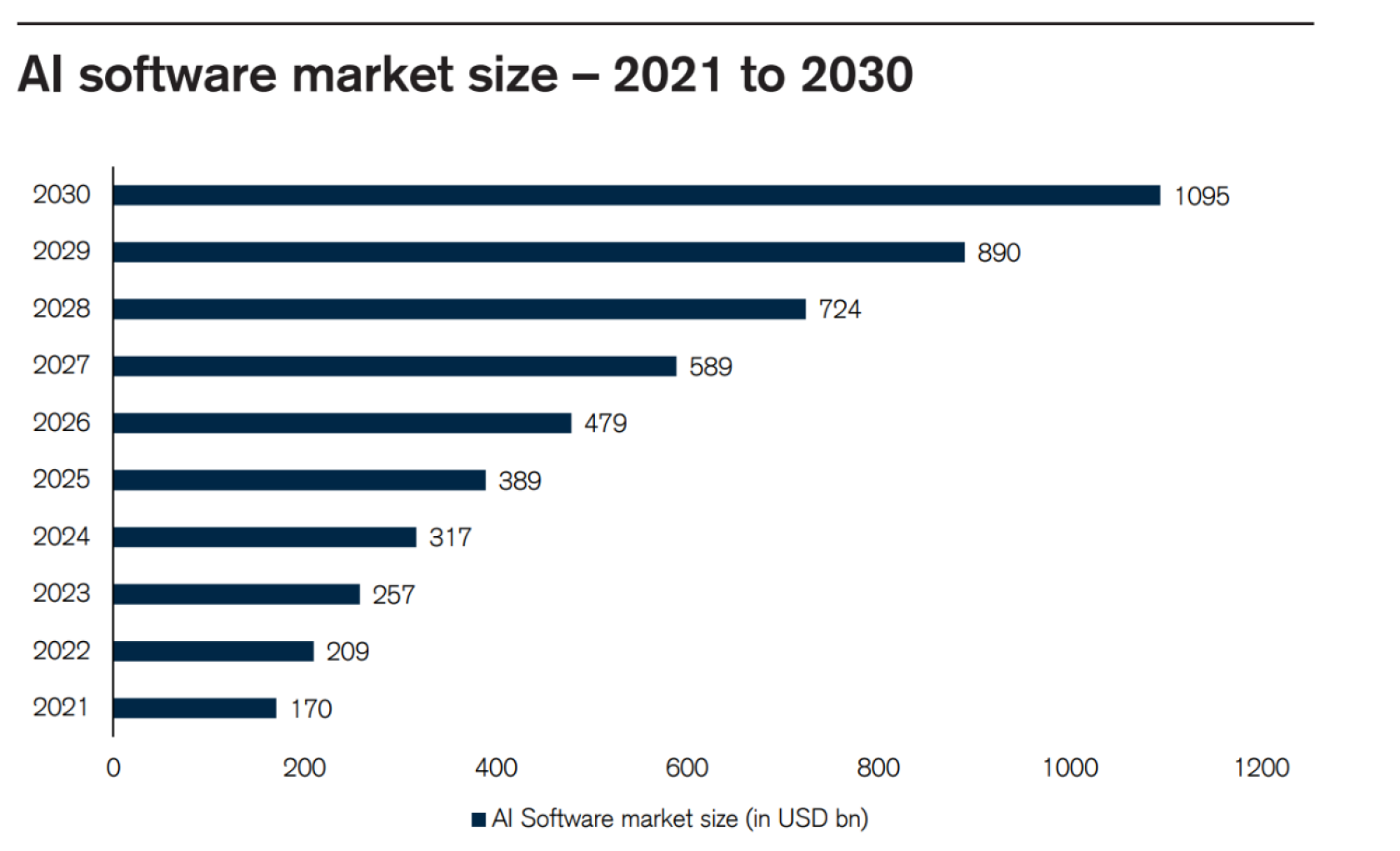

While it is too early to quantify the size of a potential new market for such AI applications (there are many AI apps that can create music or pictures, for example.) in our view, one can imagine that the market will only go up and it is a good example of how digital innovation activity continues to gain share. According to industry research (Precedence Research), the AI software market is expected to grow at a compound annual growth rate (CAGR) 2021 – 30E of 23%, starting with an expected size of USD 170 bn in 2023 and reaching USD 1.09 trn in 2030, which includes many other ways in which AI is already used in software in various industries.

What is ChatGPT

OpenAI was founded as a non-profit company developing AI that “benefits humanity as a whole,” initially funded with USD 1 bn by Elon Musk and Sam Altman in 2015 and later Peter Thiel and Reid Hoffman. In 2019, it was converted to a for-profit company under an unusual “capped profit” structure, where investors can “only” earn up to a 100x return on their initial investment. Also in the same year, Microsoft invested USD 1 bn into the company under an agreement to exclusively use Azure, according to press reports. Since its public launch in November 2022, ChatGPT usage has exploded: the chatbot had 57 million unique views in December, and its first month had 266 million visits according to Similarweb. Riding this success, OpenAI is reportedly considering a tender offer valuing itself at USD 29 bn, after a previous tender offer at USD 14 bn in 2021. Microsoft also announced its intention to integrate ChatGPT with its software stack and cloud infrastructure, in turn significantly improving functionality of its tools and the user experience.

How can we get exposure to this sub-theme?

The broad nature of AI provides many opportunities for investors to gain exposure to this sub-theme. However, we believe there are three segments that are going to benefit the most - hyperscalers, enablers, and application developers.

AI/machine learning (ML) occurs in data centers as they can theoretically scale data and compute capabilities for any specific project endlessly and thus, provide the perfect environment to train large-scale AI models. If we apply the gold rush analogy, investing in hyperscalers is somewhat akin to investing in gold mine owners where mining operation is done by third parties. Keep in mind that data centers are not limited to AI; in fact, AI is just one application among others that offer elastic scale and compute capabilities for data. In this segment, we highlight Amazon, Microsoft, Google, and Baidu as clear leaders. In North America and Europe, we would argue that the lead hyperscalers have gained in terms of storage and compute capabilities as well as software distribution is growing and largely insurmountable. For instance, Microsoft’s total cloud business revenues run rate in Q2 FY 2023 was USD 108 bn, having grown 5x over the past five years and is now larger than Microsoft’s total revenue base in any year prior to FY 2018. Once a customer “platforms” on AWS or Azure and adopts software modules, it quickly becomes uneconomical to unwind. Having said that, the relationship is often a win-win for customers and hyperscalers. By vertically integrating and leasing compute and storage capabilities to third parties, hyperscalers can simultaneously lower opex and capex for their customers while still generating very healthy operating margins.

Hyperscaler cloud market share

Microsoft and Google lead the pack, but do not forget Amazon

We believe that the large cloud service platform companies are long-term beneficiaries of AI. The most discussed company among investors is Microsoft as it was the first to announce that it will offer ChatGPT to its cloud service customers soon. In addition, investors want to know if it can gain market share in search by improving its search platform Bing by adding ChatGPT capabilities. Experts on generative AI are advising to look at three important metrics to find out the best technology.

- The first metric is the number of parameters a Large Language Model (LLM) uses. The higher the number of parameters the better the accuracy of the outcome. ChatGPT-3 has 175 billion parameters, compared to 1.5 billion parameters used in the ChatGPT-2 version in 2020. Google’s Bard is based on its Language Model for Dialogue Applications (LaMDA) model and uses 137 billion parameters. Microsoft seems to have an advantage currently; however, the development of adding parameters to the LLM is going fast and we believe that Alphabet can catch up in the near term. Google’s live presentation on Bard on 8 February failed to convince investors about its accuracy, followed by the negative share price reaction, which however we see as exaggerated and believe there is scope to improve.

- The second metric to look at is the size of the database with which the LLM can be trained. Alphabet has the largest available database given its various platforms such as Google Search, Google Maps, YouTube, etc.

- The third metric is the processing capacity as this is currently the limiting factor to improve size of parameters and training of LLMs. Both companies have deep pockets to be able to invest in processing power in data centers. However, investors should not forget Amazon, which has also invested a lot in AI and has a much larger network infrastructure for cloud services versus Microsoft and Alphabet. We expect that Amazon as well will sooner or later offer cloud applications based on generative AI for its enterprise customers.

Semiconductor companies should benefit the most

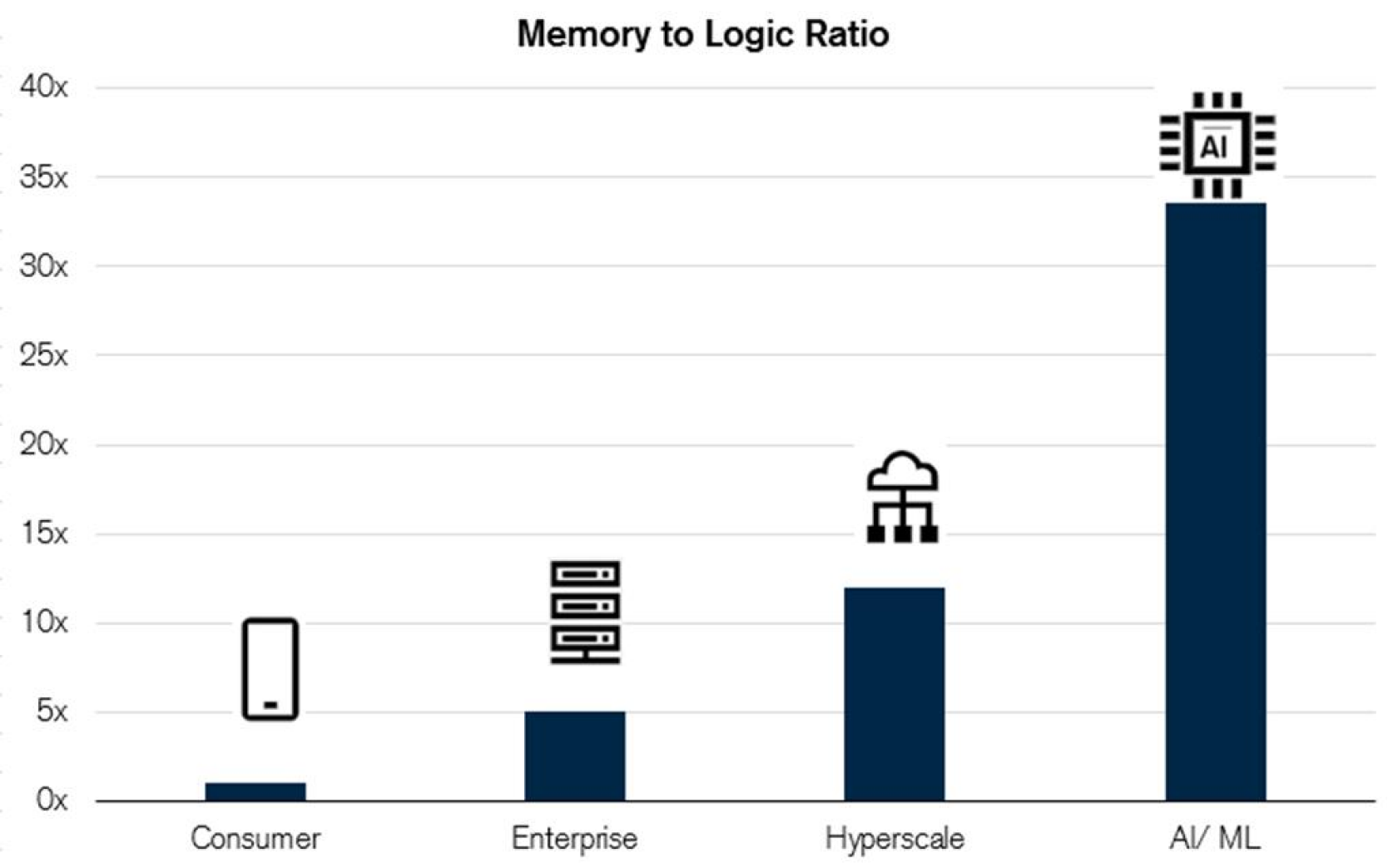

Another beneficiary is the semiconductor sector, which provides key inputs to process complex calculations; essentially, these companies sell pickaxes to our gold bugs. No business is more associated with advanced computing than Nvidia, whose graphical processing units (GPUs) are present in approximately 85% of the world’s supercomputers. GPUs are well suited for large-scale AI training development relative to central processing units (CPUs) because they perform many more calculations simultaneously. For context, in its last Investor Day presentation, Nvidia estimated that its customers’ full-stack platforms address a USD 100 trn opportunity with the company’s total addressable market (TAM) being USD 1 trn. AMD is a similar fabless chip designer that produces GPUs, but its core expertise lies in x86 CPU computer server chips. Therefore, while AMD is a key beneficiary capturing the AI trend, it remains less geared to AI as Nvidia and retains a significant PC business segment. CPUs due to their more commoditized nature and less valuable impact do not have as strong pricing power as GPUs. Yet, in recent years AMD has proved itself to be a formidable operator and it has seen market share gains in both PC as well as AI end markets, albeit from a smaller base. This is largely due to its effective chiplet designs, which have some AI training processing benefits. Ultimately, we expect both Nvidia and AMD to become incumbents. TSMC as a prominent leading-edge foundry is a long-time partner of both Nvidia and AMD and therefore is well positioned to ride the secular wave of digitalization. Given the increasing capital intensity for each successive chip node, foundry businesses such as TSMC are entrenched and enjoy quasi-monopoly level pricing power. For instance, TSMC spent USD 36 bn in FY 2022 on capex and expects to spend a similar amount next year, which is a significant exclusion cost for trailing foundries. DRAM memory is another area particularly geared toward AI and digitalization. Indeed, GPUs have no internal memory storage, thus a DRAM chip is required to store and constantly “feed” data for GPUs to process. Furthermore, the capital intensity required to build new memory fabs has also increased dramatically, which led to significant consolidation on the supply side. Today, only three large memory providers (Samsung, Micron, SK Hynix) remain within DRAM alongside several new demand sources led by AI. Therefore, we expect improving unit economics and a rising trend to lift all boats.

Memory will be used much more in data centers for AI processing

New opportunities for Software-as-a-Service companies

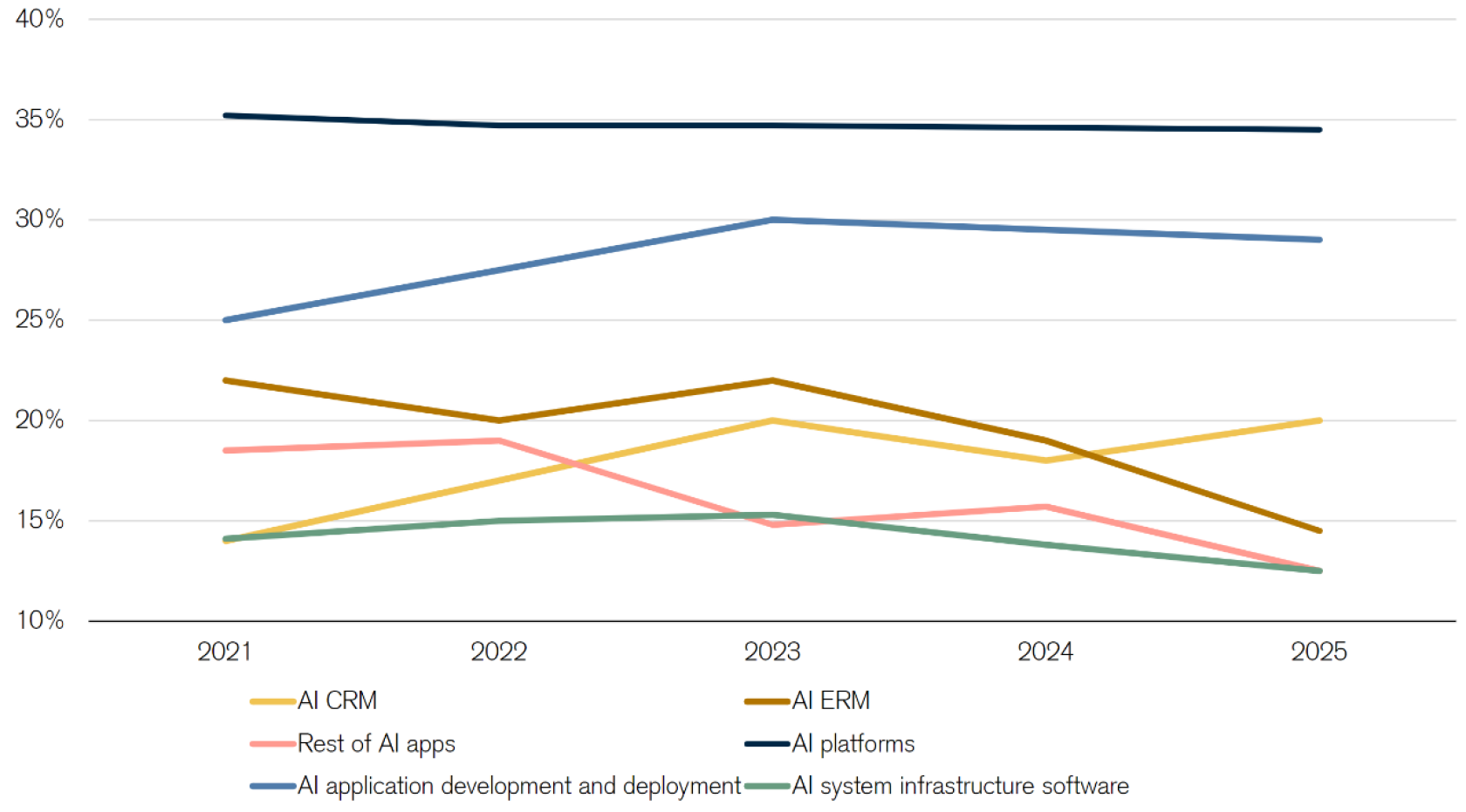

The third category of companies that could benefit from the rising adoption of AI applications are the cloud Software-as-a-Service (SaaS) vendors, in our view. Some companies already offer AI applications, for example Salesforce.com’s application (named Einstein) within its Lighting platform has been developed for its Customer Success Platform and started in 2016. We believe that the established SaaS companies might find ways to upsell and monetize additional new next-generation AI applications that they offer within their own user interface to their customer base. The next-generation Network-as-a-Service company Cloudflare also started seven years ago using machine learning for bot detection, identifying anomalies, customer support and business intelligence. It is working together with Nvidia and extended its “Workers platform” (a platform where users can write codes in any language) and included Nvidia GPUs and TensorFlow, which enabled customers to build AI-based applications that run across the Cloudflare network. According to IDC, the AI-software application market in all sub-segments of the SaaS software industry should grow in double-digit in the next five years. After the sharp valuation multiple correction of SaaS software stocks last year, we believe that the valuations have become attractive now, which do not reflect those structural long-term growth drivers

Worldwide AI software market forecast

While we think it is too early to expect material monetization from the usage of generative AI in the near term, we believe it will become a new driver of growth for the IT sector.

Historical performance indications and financial market scenarios are not reliable indicators of future performance.

All investments involve some level of risk. Simply defined, risk is the possibility that you will lose money or not make money. Before you invest, please make sure you understand the risks that apply to the products. As with any investment, you could lose money over any period of time.

Interest rate and credit risks: The retention of value of a bond is dependent on the creditworthiness of the Issuer and/or Guarantor (as applicable), which may change over the term of the bond. In the event of default by the Issuer and/or Guarantor of the bond, the bond or any income derived from it is not guaranteed and you may get back none of, or less than, what was originally invested.

To the extent that these materials contain statements about the future, such statements are forward looking and are subject to a number of risks and uncertainties and are not a guarantee of future results.

Monthly “90 seconds with” podcast: September 2023

Still focused on quality